Tesla Stock Outlook

The outlook for Tesla stock in 2024 is influenced by various factors. Here are the key elements to consider when evaluating Tesla’s future performance:

1. Financial Performance

- Revenue and Profit: Tesla continues to demonstrate strong revenue growth and profitability. Increased production volumes, the introduction of new models, and global market expansion are likely to drive further revenue growth.

- Operating Income: Tesla has consistently improved its operating income in recent years, and this trend is expected to continue in 2024.

2. New Products and Technological Innovation

- New Models: Tesla plans to launch new vehicle models and update existing ones. Notable upcoming releases include the Cybertruck and the new Roadster, which are generating significant interest.

- Battery Technology: Tesla is focused on innovating battery technology to reduce costs and improve efficiency. If the new battery cells and manufacturing processes announced during Battery Day are realized, they could have a substantial impact.

- Energy Business: Tesla is expanding its energy storage systems and solar business, which could contribute to revenue diversification in the long term.

3. Market Expansion

- Global Market: Tesla is strengthening its presence in the US, China, Europe, and other global markets. Success in the Chinese market, in particular, is a critical growth driver.

- Production Facilities: Tesla is building new factories and expanding existing ones to increase production capacity. This expansion could lead to higher vehicle output and cost savings.

4. Competitive Landscape

- Electric Vehicle Market: The electric vehicle market is rapidly growing, with both traditional automakers and new electric vehicle startups entering the space. Tesla’s ability to maintain or expand its market share will be crucial.

- Autonomous Driving Technology: Tesla is heavily investing in autonomous driving technology. The advancement and regulatory approval of these technologies will significantly impact Tesla’s future growth.

5. Economic and Policy Factors

- Government Policies: Government support for electric vehicles in various countries can positively impact Tesla. In particular, pro-environment policies in the US and Europe will aid Tesla’s growth.

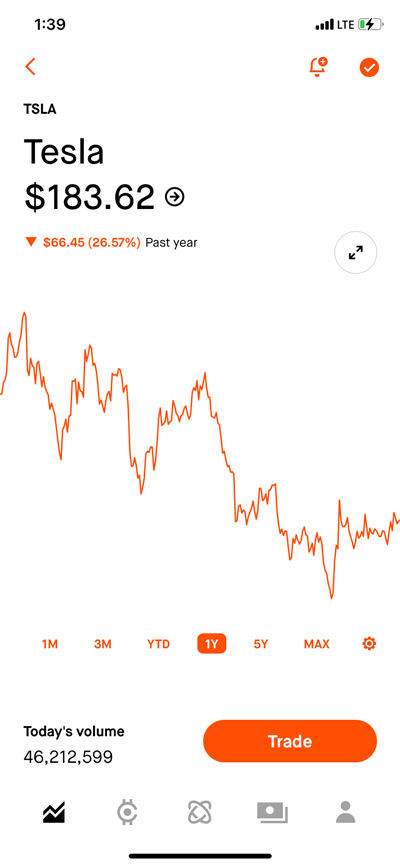

- Interest Rates and Economic Conditions: Changes in interest rates and the global economic environment can influence consumer purchasing power. Economic uncertainties may increase Tesla’s stock volatility.

6. Investor Sentiment

- Stock Valuation: Tesla has a high price-to-earnings (P/E) ratio, reflecting investor expectations for future growth. Changes in investor sentiment can greatly impact the stock price.

- Institutional Investors: Movements by institutional investors buying or selling Tesla shares can also significantly affect the stock price.

Conclusion

The outlook for Tesla stock includes both positive factors and challenges. Strong financial performance, technological innovation, and global market expansion are positive drivers, while increased competition and economic uncertainties pose challenges. Investors should consider these factors comprehensively when making investment decisions.

No Comments

Sorry, the comment form is closed at this time.